يامازاكي حامل اكسسوارات من هوم 2311 - حامل مجوهرات ومنظم تخزين، مقاس واحد، ابيض : Amazon.ae: ملابس وأحذية ومجوهرات

سمارت للهدايا والمنظفات - حامل اكسسوارات شكل جسم ستاند حديد - 6.50 دينار حامل خواتم شكل طاولة - 5.95 دينار حامل اكسسوارات شكل جسم صغير - 4.95 دينار حامل اكسسوارات شكل حذاء -

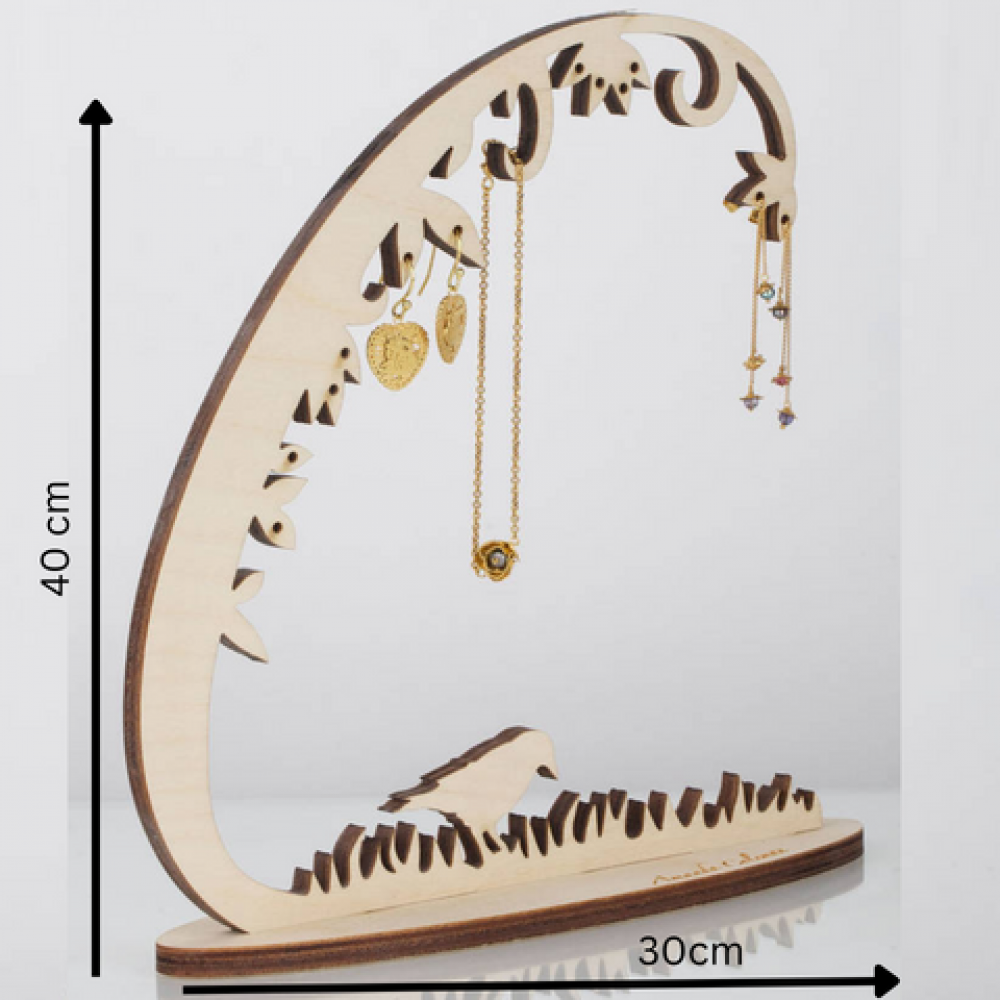

41 سنتيمتر 3 نمط مجوهرات دوارة عرض موقف حامل القرط عرض الحديد الإطار قلادة حامل الاكسسوارات قاعدة التخزين درو 1 قطعة C173 من 14.91ر.س | DHgate

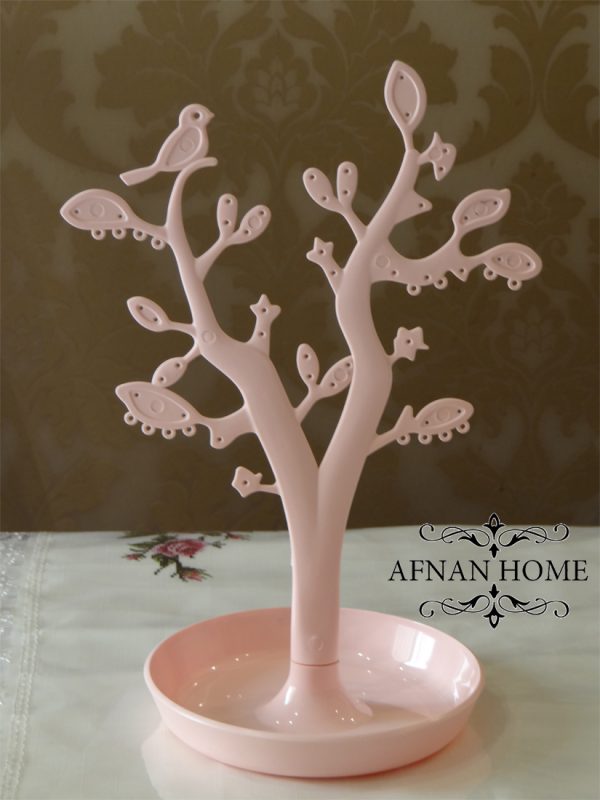

حامل اكسسوارات | بروكيس حامل مجوهرات للقلادات، رف مجوهرات من 4 طبقات مع صينية للاقراط والثقوب، 10 خطافات للقلادات، منظم عرض شجرة لتخزين الاساور والساعات والاقراط والخواتم - رمادي

منظم حامل Scrunchie حامل سوار اكسسوارات اكسسوارات مجوهرات الشعر التعادل لطيف ستوف ل غرفة نوم مصفف الشعر المثالي Dislpay، ويمكن أيضا أن يكون القدح شجرة الوقوف كأس الرف : Amazon.ae: ملابس وأحذية

تسوق اونلاين حامل اكسسوارات على شكل يد من برافو في جدة الدمام والرياض أفضل الأسعار✓ تسوق آمن ✓ شحن سريع ✓ الدفع عند الاستلام - مراكز برافو الدوليه

-530x618.jpg)