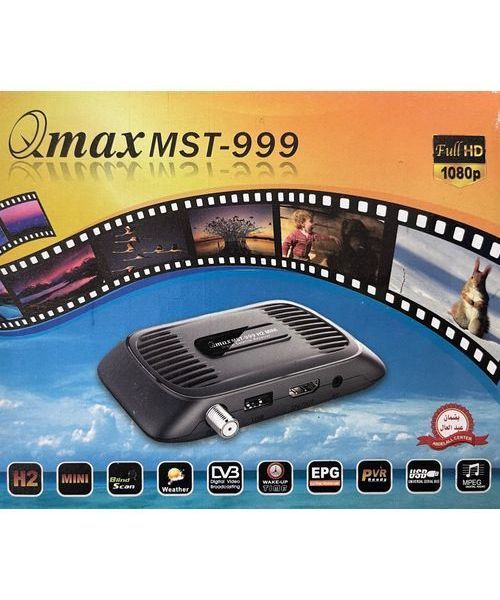

تلفزيون عالي الدقة Satelitní přijímač FTA receiver تلفزيون رقمي وحدة وصول مشروط ، cloude, التلفزيون, الإلكترونيات png

W3 2.4G ماوس هوائي لاسلكي | التحكم الصوتي الذكي عن بعد | تصميم نحيف للغاية | لوحة مفاتيح صغيرة | متوافق مع التلفزيون الذكي / الأجهزة اللوحية / الرسيفر / الكمبيوتر / أجهزة العرض | - متجر حمد ستور الإلكتروني

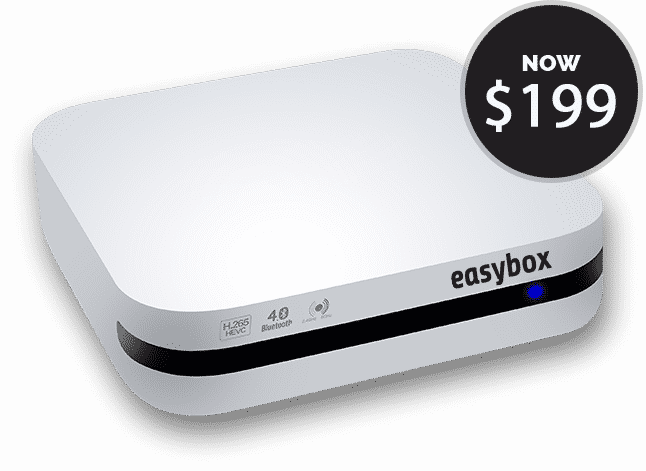

لاتحتاج صحن الستلايت بعد الأن . يتوفر لدى ماركت البيت العراقي في أنطاليا . جهاز رسيفر أندرويد يعرض جميع القنوات بالعالم . يحول جهاز التلفزيون العادي الى نظام الأندرويد . ويتوفر بيع

W3 2.4G ماوس هوائي لاسلكي | التحكم الصوتي الذكي عن بعد | تصميم نحيف للغاية | لوحة مفاتيح صغيرة | متوافق مع التلفزيون الذكي / الأجهزة اللوحية / الرسيفر / الكمبيوتر / أجهزة العرض | - متجر حمد ستور الإلكتروني

تلفزيون بشاشة عريضة محمولة 10 بوصة - موالف تلفزيون رقمي لاسلكي ذكي للسيارة ببطارية قابلة لاعادة الشحن، شاشة LCD TFT 1024x600p مع مكبرات صوت ستيريو مزدوجة، USB، هوائي، جهاز تحكم عن بعد،

جهاز إرسال إشارة لاسلكي FJ، محول استقبال AV لاسلكي 5.5 جيجاهيرتز مع 24 قناة ومحول طاقة و2 كابل RCA للتلفزيون AV STB Audio Video : Amazon.ae: الإلكترونيات والصور

660ft لاسلكي HDMI نقل الفيديو اللاسلكي التلفزيون HDMI استقبال (فقط RX) مع الأشعة تحت الحمراء واي فاي هوائي موسع عدة 200 متر - AliExpress

جهاز الترفيه المنزلي | Mi Box 4K | ( + ) اشتراك سنة واحدة على القنوات الحصرية ( القناة + سلسلة + أفلام + رسوم متحركة ) - متجر حمد ستور الإلكتروني

جهاز إرسال واستقبال الفيديو الصوتي والتلفزيون اللاسلكي PAT-590 من PAKITE، إشارة رقمية 328 قدم ناقل حركة عالي الدقة 1080P 3D مع هوائي مزدوج يعمل بالتحكم عن بعد: اشتري اون لاين بأفضل الاسعار

اي او جير اللاسلكي طويل المدى 5×2 اتش دي ام اي ماتريكس برو مع 3 رسيفر إضافي، GWHDMS52MBK4 : Amazon.ae: الإلكترونيات والصور