8 قطعة أنابيب الغاز الهوائية إدراج سريع وسريع مباشرة من خلال المخفض محول Pg البلاستيك مباشرة من خلال 8-6 Pu أنابيب الغاز/مكونات هوائية سريعة - المنتجات الصناعية والتجارية - Temu Bahrain

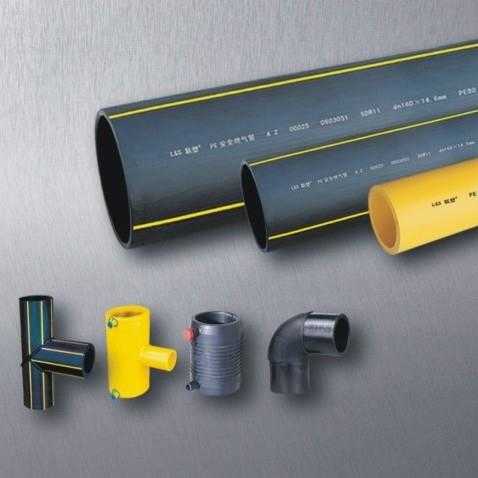

أنابيب غاز صفراء وتركيبات PEX AL PEX الأنابيب المصنعين والموردين - مصنع بالجملة - EO الأنابيب البلاستيكية

أنابيب الأكسجين CO2 SCBA PCP أنابيب غاز بدون درزات - الصين أسطوانة غاز بدون درزات، أسطوانة غاز الأكسجين، خزان غوص، أسطوانة الأكسجين، أسطوانة الأكسجين الطبية، أسطوانة الغاز، أسطوانة Scuba، أسطوانة غوص، أسطوانة

الصين تخصيص 140mm 4L الصناعية الأرجون الغاز اسطوانات الموردين والمصنع والمصدر - اقتباس بالجملة - YONGAN